Company Description

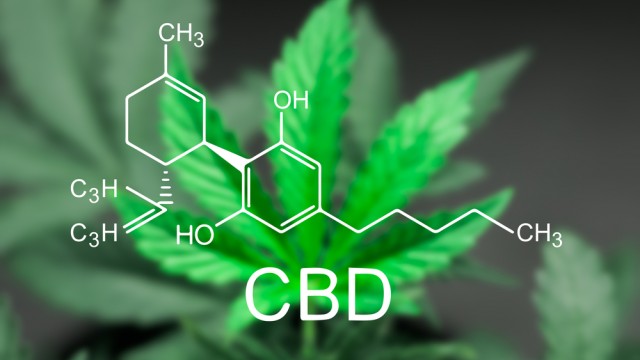

Zelira Therapeutics Limited, a bio-pharmaceutical company, engages in the research, development, and commercialisation of cannabinoid-based medicines for the treatment of various medical conditions in Australia. It offers formulations under the HOPE brand in Pennsylvania and Louisiana, as well as develops Zenivol, a cannabinoid-based medicine for treatment of chronic insomnia. The company also provides OTC products, including SprinJene, an oral care product; and RAF FIVE, a dermatology product, as well as ITURA, an advanced relief cream formula that targets multi-symptoms, such as numbness and tingling, muscle cramps, insensitivities, and pain associated with Peripheral Artery Disease and diabetes. Zelira Therapeutics has strategic partnerships with Curtin University; the Telethon Kids Institute; the University of Western Australia; St. Vincent's Hospital; and the Children's Hospital of Philadelphia. The company was formerly known as Zelda Therapeutics Limited and changed its name to Zelira Therapeutics Limited in December 2019. Zelira Therapeutics Limited was incorporated in 2003 and is headquartered in Perth, Australia.

OTC

Unprofitable

EPS improving

Unprofitable

EPS improving

3M

Biotechnology

Next Earning date - N/A

0.24USD

Relative Strenght

Volume Buzz

204%Earning Acce

NoDist 52w H.

52%