Quote Panel

Key Metrics

Fundamentals

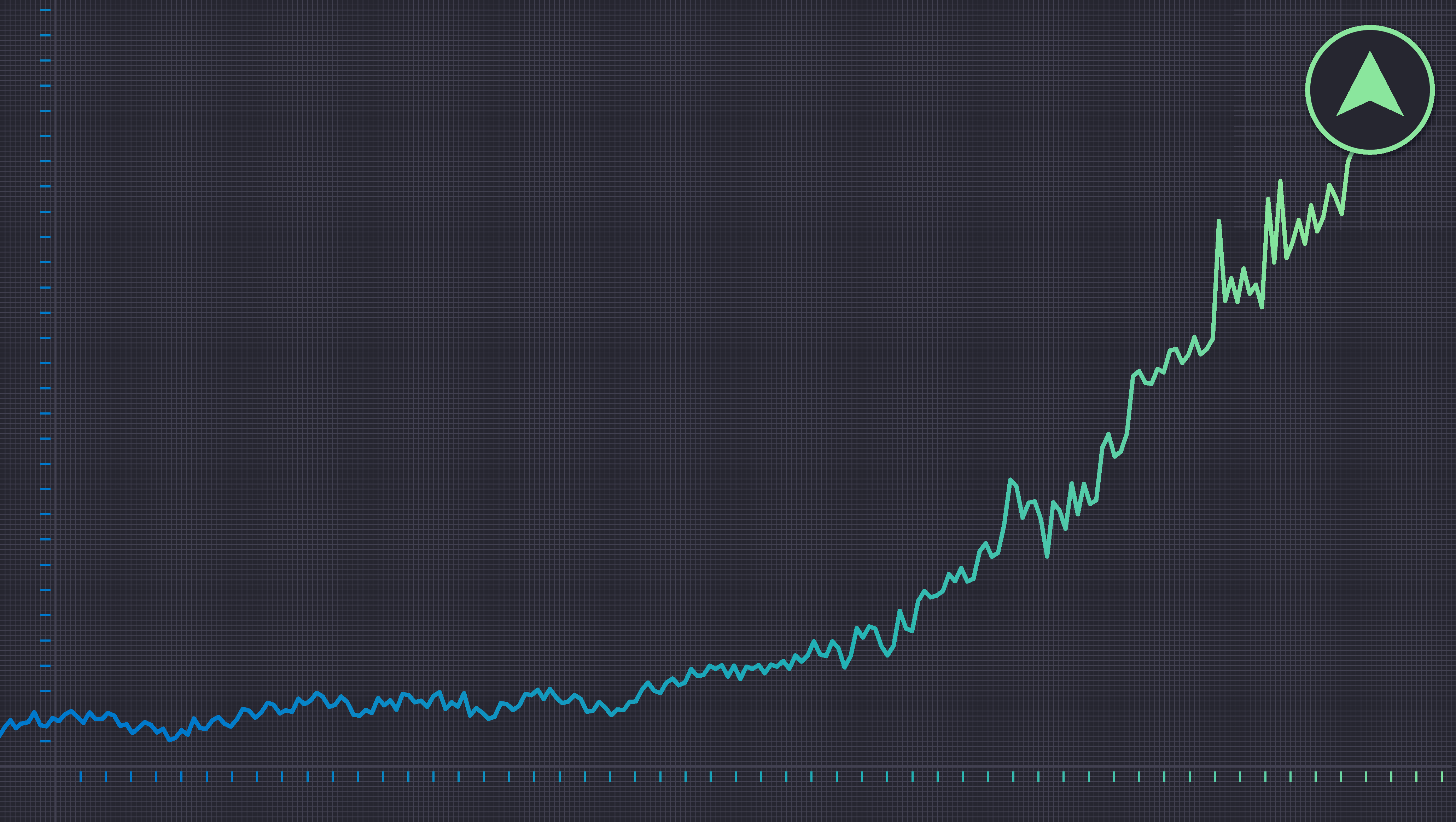

Relative Strength

WOLF

Sector

Top 5 RS in Group

Symbol | Company | RS | 5-Day Perf. |

|---|---|---|---|

Forecast

Analyst rating

Last analyst upgrade/downgrade

Chrome Plugin Live! Redefine the way you read FinTwit 🚀 Install Now

Quote Panel

Key Metrics

Fundamentals

Relative Strength

WOLF

Sector

Top 5 RS in Group

Symbol | Company | RS | 5-Day Perf. |

|---|---|---|---|

Forecast

Analyst rating

Last analyst upgrade/downgrade

Earnings Growth

YoY

Current

Estimates

Q3.23

N/A

-0.53

vs -0.04

Q4.23

N/A

-0.55

vs -0.11

Q1.24

N/A

-0.62

vs -0.13

Q2.24

N/A

-0.89

vs -0.42

Q3.24

N/A

-0.91

vs -0.53

Q4.24

N/A

-0.95

vs -0.55

Q1.25

N/A

-0.72

vs -0.62

Q2.25

N/A

-0.77

vs -0.89

Q3.25

N/A

-0.62

vs -0.91

Q4.25

N/A

-0.59

vs -0.95

Sales Growth

YoY

Current

Estimates

Q3.23

-18%

197.4M vs 241.3M

Q4.23

+20%

208.4M vs 173.8M

Q1.24

-12%

200.7M vs 228.7M

Q2.24

-15%

200.7M vs 235.8M

Q3.24

-1%

194.7M vs 197.4M

Q4.24

-13%

180.5M vs 208.4M

Q1.25

-8%

185.4M vs 200.7M

Q2.25

-2%

197M vs 200.7M

Q3.25

+2%

198M vs 194.7M

Q4.25

+13%

203.7M vs 180.5M

Return on Equity

QoQ

Q1.23

-6%

-0.06

vs -0.05

Q2.23

-7%

-0.07

vs -0.06

Q3.23

-32%

-0.32

vs -0.07

Q4.23

-13%

-0.13

vs -0.32

Q1.24

-15%

-0.15

vs -0.13

Q2.24

-20%

-0.20

vs -0.15

Q3.24

-45%

-0.45

vs -0.20

Q4.24

-100%

-1.00

vs -0.45

Q1.25

-134%

-1.34

vs -1.00

Q2.25

+150%

1.5

vs -1.34

Institutionnal Ownership

QoQ

Q1.23

504

504

vs 534

-6%

Q2.23

477

477

vs 504

-5%

Q3.23

451

451

vs 477

-5%

Q4.23

458

458

vs 451

2%

Q1.24

436

436

vs 458

-5%

Q2.24

398

398

vs 436

-9%

Q3.24

380

380

vs 398

-5%

Q4.24

368

368

vs 380

-3%

Q1.25

365

365

vs 368

-1%

Q2.25

255

255

vs 365

-30%

seekingalpha.com

8 hours ago

invezz.com

10 hours ago

fool.com

12 hours ago

fool.com

14 hours ago

seekingalpha.com

14 hours ago

youtube.com

14 hours ago

Forecast

2026-Revenue

2026-EPS

2026-EBITDA

Analyst rating

Price Target

0.00(N/A)

Number of analyst

0

Last analyst upgrade/downgrade

New Street

downgradePrevious: Not converted

2024-08-07

Now: Neutral

William Blair

downgradePrevious: Outperform

2024-05-02

Now: Market Perform

Oppenheimer

downgradePrevious: Outperform

2023-04-27

Now: Perform

Susquehanna

initialisePrevious: Not converted

2022-12-12

Now: Neutral

Quote Panel

Key Metrics

Relative Strength

WOLF

Sector

Top 5 RS in Group

Symbol | Company | RS | 5-Day Perf. |

|---|---|---|---|

Fundamentals

P/E Ratio

P/S Ratio

P/B Ratio

Debt/Equity

Net Margin

EPS

How WOLF compares to sector?