Company Description

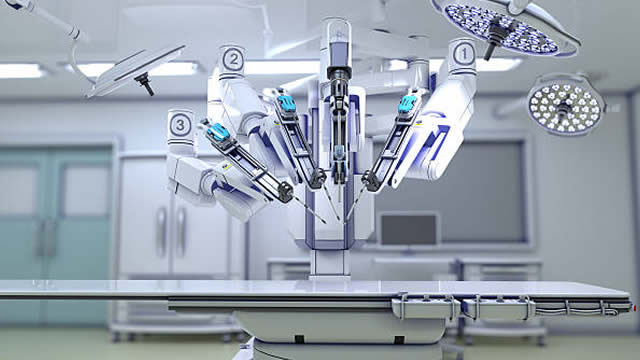

Medpace Holdings, Inc. provides clinical research-based drug and medical device development services in North America, Europe, and Asia. It offers a suite of services supporting the clinical development process from Phase I to Phase IV in various therapeutic areas. The company also provides clinical development services to the pharmaceutical, biotechnology, and medical device industries; and development plan design, coordinated central laboratory, project management, regulatory affairs, clinical monitoring, data management and analysis, pharmacovigilance new drug application submissions, and post-marketing clinical support services. In addition, it offers bio-analytical laboratory services, clinical human pharmacology, imaging services, and electrocardiography reading support for clinical trials. The company was founded in 1992 and is based in Cincinnati, Ohio.

NASDAQ

14B

Medical - Diagnostics & Research

Next Earning date - 20 Oct 2025

14B

Medical - Diagnostics & Research

Next Earning date - 20 Oct 2025

501.94USD

Relative Strenght

89Volume Buzz

-61%Earning Acce

NoDist 52w H.

1%