You have successfully sign out

Loading...

Global Atomic Corporation

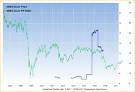

GLO.TO

Company Description

Global Atomic Corporation engages in the acquisition, exploration, and development of uranium properties in Niger. It owns 100% interest in the Dasa deposit located in the Republic of Niger. The company also processes electric arc furnace dust into zinc concentrates, which is sold to zinc smelters. Global Atomic Corporation is headquartered in Toronto, Canada.

TSX

Unprofitable

Unprofitable

263M

Industrial Materials

Next Earning date - 07 Nov 2024

263M

Industrial Materials

Next Earning date - 07 Nov 2024

1.11CAD

Market Open

Relative Strenght

Volume Buzz

10%Earning Acce

NoDist 52w H.

72%