Company Description

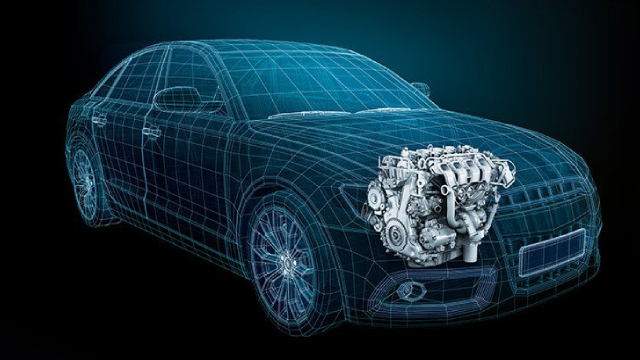

BAIC Motor Corporation Limited, together with its subsidiaries, manufactures and sells passenger vehicles in the People's Republic of China. The company provides luxury passenger cars, luxury commercial vehicles, middle-end and high-end passenger cars, and self-owned passenger cars. It also provides engines, powertrain, other parts, and components. In addition, the company is involved in research, development, as well as after-sales services of passenger vehicles. Further, the company produces core parts and components of passenger vehicles, as well as engaged in car financing and investment management businesses. The company sells its products under the Beijing Brand, Beijing Benz, Beijing Hyundai, and Fujian Benz names. BAIC Motor Corporation Limited was founded in 1958 and is headquartered in Beijing, the People's Republic of China.

OTC

EPS improving

EPS improving

2B

Auto - Manufacturers

Next Earning date - 25 Aug 2025

2B

Auto - Manufacturers

Next Earning date - 25 Aug 2025

0.26USD

Relative Strenght

Volume Buzz

-21%Earning Acce

NoDist 52w H.

25%